- The financial markets are experiencing a complex interplay with the yen’s strength influencing Bitcoin and Nasdaq trends, and driving global risk aversion.

- The Japanese yen has historically supported asset valuations with low yields but is now gaining strength, creating unease across markets.

- Traders are heavily invested in the yen’s continuous rise, which risks swift market reversals if expectations aren’t met.

- Financial experts, such as Morgan Stanley’s G10 FX team, advise caution against betting excessively on yen appreciation.

- Domestic factors, including NISA and Japan’s public pension funds, influence the yen’s trajectory by mediating its upward trend.

- Historical patterns suggest potential reversals as the markets recover, with Bitcoin and the USD/JPY pair poised for rallies after substantial dips.

- The U.S.-Japan yield differential is a critical factor in sustaining the yen’s bullish momentum, suggesting long-term implications.

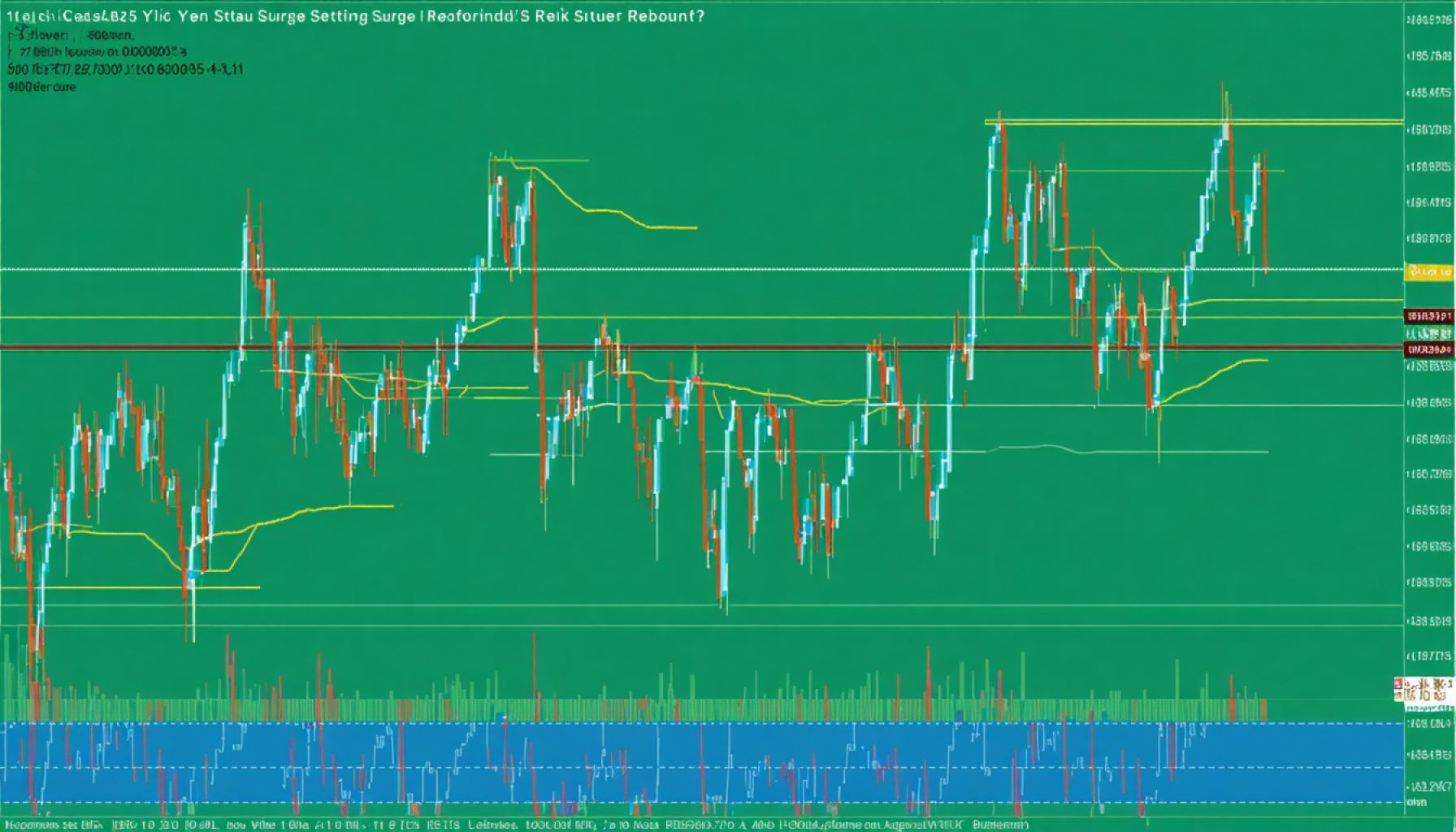

A peculiar tapestry unfolds in the financial world, where each thread weaves a tale of interconnected destinies. Recently, the Nasdaq and Bitcoin have wavered, almost echoing in synchrony with the soaring yields of Japanese government bonds and the fortification of the seemingly invincible Japanese yen. This eerie parallel evokes memories of a similar dance witnessed in the markets earlier in August.

For decades, the Japanese yen, with its traditionally low yields, has buttressed global asset valuations. But now, as this currency flexes its muscles, a ripple of unease has spread across Wall Street and the ever-volatile cryptocurrency market. It’s more than a mere spectacle; it’s a complex narrative of risk aversion unfolding in real time.

Speculative fervor surrounds the yen like a frenzied symphony. Last week, traders held record-long positions, a confident gamble that the yen would continue its ascent. Yet, this bullish consensus can be a setup for swift reversals when expectations collide with reality. The swelling tide could soon ebb, allowing risk assets, such as Nasdaq stocks and Bitcoin, to breathe a sigh of relief.

Strategy whispers from financial giants, like Morgan Stanley’s sharp-minded G10 FX team, caution against betting too heavily on further yen appreciation. It’s not just the speculative dynamics at play; domestic forces, such as the Nippon Individual Savings Account (NISA) and the behavior of Japan’s public pension funds, play a pivotal role in shaping this currency narrative. When Japanese investors dip into foreign assets, believing in broader market recoveries, they lend an unintended hand in tempering the yen’s upward rush.

This isn’t the first act in this financial drama. A similar scenario unfolded last August, with the yen’s meteoric rise triggering a drastic sell-off in equities, only to later pave the way for a risk-on revival. Historically, we’ve seen the USD/JPY pair rebound after touching low points, and Bitcoin stride from losses to highs, painting a landscape where history’s echoes can lead to rejuvenated investor confidence.

As of now, Bitcoin hovers close to $80,300, reflecting the whiplash of recent corrections, and the USD/JPY pair flirts with levels around 147.23. The past month has been nothing short of a roller coaster—prices sagging only to hint at recovery.

It could all be just a temporary respite. While speculative forces and institutional comings and goings offer glimmers of hope, the yen’s broader bullish momentum is underpinned by more foundational shifts. A crucial factor: the narrowing yield differential between the U.S. and Japan—a subtle yet powerful tilt in the economic landscape, signaling a long-term embrace of yen strength.

In this suspenseful saga, vigilance becomes key. For investors navigating these turbulent seas, eyes must remain wide open for fluctuations in the yen and the larger, tempestuous currents of the financial markets. As the story unfolds, only time will tell if the yen’s recent surge truly heralds a new dawn for the Nasdaq and Bitcoin, or if this is merely a fleeting chapter in the annals of market history.

Experts Predict How the Japanese Yen’s Strength Could Impact Global Markets in 2024

Understanding the Impact of the Japanese Yen’s Strength on Global Markets

In recent months, the Japanese yen’s strengthening has sent ripples through the world of finance, affecting global markets, including the Nasdaq and Bitcoin. To better understand the broader implications and opportunities, let’s delve into the various aspects of this phenomenon.

How-To: Manage Investments Amid Yen Volatility

1. Diversification: Allocate assets across sectors and geographic regions to hedge against currency volatility.

2. Currency Hedging: Consider using currency hedges if you have significant investments in Japanese equities or yen-denominated assets.

3. Monitor Economic Indicators: Keep an eye on yield differentials and economic policy changes in both the U.S. and Japan as they can influence currency movements.

Real-World Use Cases

Many Japanese investors leverage the strong yen to invest in foreign assets, thereby diversifying their portfolios and potentially enhancing returns. This trend affects the yen’s strength and global asset prices, making foreign exchange rates critical for international businesses.

Market Forecasts & Industry Trends

1. Yen Strength: If Japan maintains its current policy settings and the U.S. shows signs of slowing rate hikes, the yen could continue to appreciate in 2024.

2. Tech Sector Impact: The Nasdaq might face pressure due to the yen’s influence on Japanese tech companies with significant contributions to the index.

Reviews & Comparisons

Let’s compare Japanese yen’s performance against other key currencies:

– Yen vs. USD: Historically low yields have turned, with expectations of further gains if the Federal Reserve eases interest hikes.

– Yen vs. Euro: Similar dynamics are at play, reflecting broader Eurozone economic challenges and opportunities.

Controversies & Limitations

1. Speculation Risk: While the yen’s appreciation creates opportunities, heavy speculative positions can lead to abrupt market corrections.

2. Policy Changes: Sudden policy announcements by the Bank of Japan (BoJ) or the Federal Reserve could affect current trends swiftly.

Insights & Predictions

Expert analysis suggests a potential retreat for the yen if Japan’s economic data reveals weaknesses, leading to increased volatility for global equities and cryptocurrencies. However, if Japan’s GDP growth exceeds expectations, the yen may sustain its strength.

Actionable Recommendations

1. Stay Informed: Subscribe to financial newsletters and regularly check updates from reliable sources like Reuters or Bloomberg.

2. Engage Financial Advisors: Consider professional advice for managing exposure to currency risk amid volatile markets.

3. Long-term Strategies: Formulate a plan considering possible scenarios of yen strengthening or weakening, and adjust portfolios accordingly.

As the intricate tapestry of financial markets continues to unfold, these strategies and insights can help investors navigate the challenges and embrace potential opportunities in the evolving financial landscape.